|

| Find Out About Plastics - My End-Of-The-Year Review 2022 and Outlook 2023 |

Hello and welcome to my end-of-the-year review 2022 and outlook for 2023. I walk you through this year and touch briefly on all published posts.

January

In January we kicked off the blog year with an overview and definitions of sustainability in the Plastics Industry. Biron [1] identified six major areas to put the focus on when implementing a sustainability concept and creating a sustainability concept is a step-by-step progress toward the best possible sustainability in your company. We had a guest interview with Mr. Max Funck from specialty compounder PlastFormance. We learned about their highly filled compounds to enhance high conductivity (thermal, electrical) and radiation shielding. Also in January we discussed some major trends to watch for in the chemical industry and continued with the Global Warming Potential (GWP) of thermoplastics. I showed the GWP values of thermoplastics compared to their different thermal properties and transitions: Tg, heat capacity (Cp), short term temperature exposure (HDT) and long term temperature exposure (UL Yellow Card). This allows for a better assessment of the different GWP values in relation to the resin properties.

Read all posts of January 2022 here

February

In February I wrote three posts on design properties for plastics engineering: Key Electrical Properties of Selected Engineering and High Performance Polymers for E-Mobility, Selected Properties of Natural Fiber Based Polymer Compounds, and Mechanical properties of PCR, PIR, bio-based, and mass balanced plastics. Apart from the engineering data post, we discussed blockchain technology as an enabler for tracing recycling content of plastic compounds and cascade recycling as a possible way forward for plastics processing companies to ensure a proper tracing of the used polymers. In another post I picked up the six strategic principles of Mark McNeilly’s book “Sun Tzu and the art of business” and tried to apply them in today’s VUCA (volatility, uncertainty, complexity, and ambiguity) plastics world. Another more hands-on post was a simple tool for calculating the residence time for extrusion operations.

Read all posts of February 2022 here

March

In March we discussed three considerations for optimal dimensional stability of plastics parts after processing. Polymer based parts have a dimensional stability which is not equal to that of metals. It can vary with several factors which we discuss in the following in more detail. If it is a critical part, this needs to be considered during the polymer material selection. Also we discussed an operational life-hack. We looked at a well-known cognitive bias that psychologists refer to as “survivorship bias” and how to use this information for better decision making in our daily plastics operation. Biopolymers were a topic in March too. I showed how you can use the 3P (price, performance, and processing)-triangle to select engineering biopolymers. In addition, we discussed three topics under the sustainability umbrella: bio sourcing, LCA, and certifications.

Read all posts of March 2022 here

April

In the month of April we discussed the DMA data of unfilled engineering polymers as well as reinforced engineering polymers. In general, the DMA is a thermo-analytical method that estimates the viscoelastic properties of a given material over the course of different temperatures. It steps away from a single point view toward a multipoint data view which is beneficial for polymer material selection tasks. Another topic was how to optimize the wall thickness of well- known PET bottles by using safety factors and the stress equations.

Read all posts of April 2022 here

May

In May I presented 6 major benefits of injection moulding simulation in polymer part design and material selection. In addition we discussed the water and moisture uptake of aliphatic short and long chain Polyamides as part of our “Plastic Part Design Properties for Engineers” series. In May we discussed the penguin circle which stands as a symbol for teamwork and leadership.

Read all posts of April 2022 here

June

In June, right before the summer, I presented the second episode of my Ocean Plastics - What The Media, NGOs and Others Still Not Tell You series. In Episode 2 we discussed all kinds of waste dumping and that the "out of sight, out of mind” attitude for dumping waste into our ocean is wrong. Also, blaming plastics to be the number one littering source for our oceans is wrong too. The data speaks a clear language. There is more and more ideological thinking involved in such anti-plastics topics and too less decision making based on facts. Plastics are part of our solution and are not the problem. Another topic in May was on the topic of flame retardants, starting with an overview and then discussing as an example effective flame retardants for Polyamides. In June I presented a summary of testing standards which is helpful in the material screening phase during polymer selection for your application to have a feeling which tests can be done and what standards are linked to them. Furthermore we discussed the HDT (1.82 MPa) of filled and unfilled amorphous and semi-crystalline polymers as part of the “plastic part design properties” series.

Read all posts of June 2022 here

July

In July we discussed what are the PTFE free alternatives for lubrication in friction and wear compounds. In conclusion, from an polymer material selection point of view, UHMW-PE is an alternative material for applications that need excellent sliding properties as well as excellent wear resistance. Furthermore, flame retardant properties can be achieved by mixing UHMW-PE (wt 80%) with PTFE (wt 20%). Another post focused on highly filled PP compounds as enabler materials for improved flame retardancy, cost, and functionality. Third topic in July was the CLTE of commodity polymers, mineral fillers and metals with the focus on how to control CLTE in an optimal way.

Read all posts of July 2022 here

August

In August I gave you an update on my HDPE plastic bag degradation experiment. This summer I spent some weeks in our apartment flat in Sesimbra, Portugal which by the way you can rent for your holiday as well. I used this time to check on my experiment which I started in January 2021. Furthermore I wrote three “Plastic Multipoint Design Data” posts : Specific Heat Capacity as a Function of Temperature, CLTE of Polymers as a Function of Temperature, and Thermal Conductivity of Polymers as a Function of Temperature. In August we discussed the starting point in polymer material selection. In general there are several procedures for material selection such as the Ashby methodology or my own developed funnel approach. However, all the selection processes and procedures should have the definition of the part requirements as their common starting point.

Read all posts of August 2022 here

September

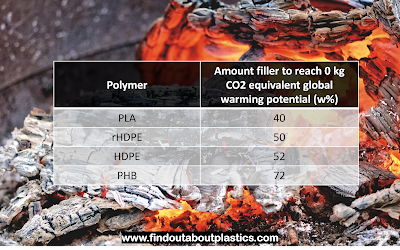

In September we discussed ways to increase the Comparative Tracking Index (CTI) of thermoplastics. In general, there are polymers which more likely form a conducting carbonized path compared to other polymers. Aliphatic and semi-aromatic polymers, polyolefins, fluoropolymers, as well as polyesters show high resistance to form a conductive carbonized path. PPS on the other hand more likely forms a conducting carbonized path, combined with a low tracking resistance. Also I presented an effective way to turn thermoplastics carbon neutral or even carbon negative. In another post we uncovered the flame retardant classification according to DIN EN ISO 1043-4. In September we answered a community question on what should be the minimum transparency level required for plastic laser welding. In general, thermoplastics transmit a near-IR beam. The upper plastics layer needs to have transparency for wavelengths between 808 nm – 1064 nm. A minimum transmission rate of 5% is required, however optimal would be 30% and greater.

Read all posts of September 2022 here

October

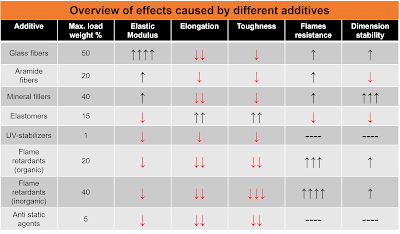

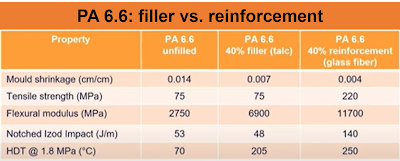

In October I started the three part series on the important role of additives (Part 1 and 2). They enhance polymer properties for high performance applications. Furthermore I showed the processing considerations of PBT and its crystallization behavior.

Read all posts of October 2022 here

November

In November we discussed the injection molding of polymers with flame retardant (FR) and how the flow and chemical resistance of amorphous polymers can be improved. In addition I presented an overview of the chemical resistance of commodity and engineering polymers. Furthermore I showed another important multipoint and long-term data set for polymer material selection and part design: tensile creep modulus.

Read all posts of November 2022 here

December

In December I presented the third part of our plastic additives series. In this post we discussed how to improve the conductivity (thermal and electrical) of polymers by using different filler systems. Also we discussed another set of multi-point design data: the brittleness as a function of temperature for amorphous and semi-crystalline thermoplastics.

Read all posts of December 2022 here

Hello 2023

In 2023, I will continue to present posts which evolve around 3 main categories:

- Polymer material selection and applying the Polymer Selection Funnel. I aim to present on a monthly basis a selection example using my funnel methodology.

- Design properties and multi-point data for engineers (incl. eco-design for sustainability in plastics) as well as design of materials using compounding and additives.

- Leadership and strategy in plastics industry

Furthermore, I invite you all to leave topics you would like to read about in 2023 in the comment box below or leave me a short message here.

I am working to publish my “Pumping Plastics” monthly newsletter as a book in 2023. More details will follow.

Last but not least, I would like to thank all readers of my posts!!!

I hope to welcome you again next year.

I wish you happy holidays and a very happy New Year 2023!

Thank you and #findoutaboutplastics,

Greetings,

Herwig Juster

*NEW* my Polymer Material Selection book is out - get a copy here